A Business Exit is Inevitable

All business owners must consider a transition from their company, whether they’re ready to leave now or 20 years from now. Studies show that without proper planning, only 20 percent of businesses are sold. That means 80 percent are not sold, which translates to lost jobs and lost revenue across the state.

A group of manufacturing business owners shared their processes for transitioning, using both internal and external methods, during a panel discussion at the OMEP Summit on March 15 in Tigard.

“Selling your business can be an emotional roller coaster. You want your legacy to go on, and if you sell to an outsider, that may not be possible” said Mike Vanier, OMEP’s VP of Client Engagement.

There is a 100 percent guarantee you will leave your business at some point. Will it be the way you wanted or will it lead to liquidation?

How to Successfully Leave Your Manufacturing Business

How to Successfully Leave Your Manufacturing Business

Success comes down to proper advance planning and seeking input for alternative solutions.

A survey of more than 100 executives of local manufacturing firms by law firm Schwabe, Williamson and Wyatt entitled “State of Manufacturing in the Pacific Northwest” revealed that only two out of five manufacturing companies have a plan in place for an executive leadership transition, while 35 percent are in the process of developing a plan.

The organizations without a plan tend to be smaller in size with revenues of less than $5 million per year.

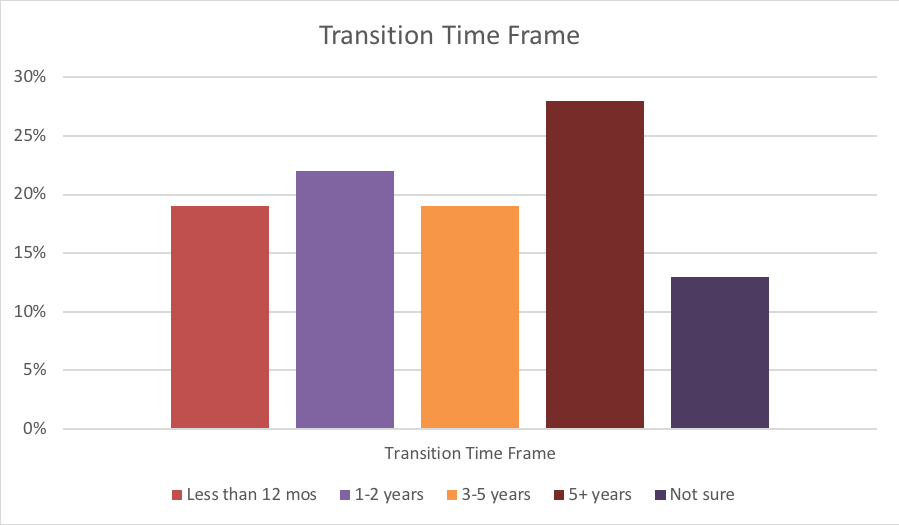

Those that do have a plan in place are split in terms of how many years in advance to start planning, starting from less than a year to more than five.

Jeffrey Stuhr founded HOLST architecture at age 29. Once he turned 50, he decided he wanted to transition out by age 55, so he started working on a plan. “Strategic business planning really sharpened our focus, so then we could focus on what would happen with the company and how the original owners would transition out,” Stuhr said.

It’s all based on relationships, both with clientele and your employees, and we really prize those relationships. How do we harness and promote our employees to stay with the company over time with the idea there would be eventual ownership?

SBA Options

His answer was to turn to the Small Business Administration to help create a plan that would be affordable for new buyers. Affordability was a big factor: many of his younger employees didn’t have the financial means because the majority of their equity was in their homes. There are many creative options that can allow the buyer to put down less money under the umbrella SBA 7a Loan Guarantee program, sometimes as low as 5 percent, with $5 million max funding available, according to an SBA spokesperson on the panel.

Private Equity

Private Equity is another option some manufacturing companies are choosing, according to panelists. While private equity companies take a percentage, that amount can range anywhere from 10 to 70 or 80 percent. It depends on a variety of factors, such as cash flow, deferred maintenance, etc. Partnering with this type of investor allows the seller to have an advisor to help guide them on all the necessary due diligence.

An Alternative Approach

The three owners of CabDoor took a different approach to transition planning. This past Christmas, they celebrated 30 years of business. Some of the employees had been there 27, 28, or 29 years. That celebration opened the owners’ eyes to how emotionally invested they have been in their employees’ lives and growth. They had been approached a few times about selling to outside buyers, but they didn’t want someone liquidating the company.

“For a long time, my vision of retirement was that we would build up the company and sell it and make a bunch of money and ride off into the sunset. I was high on the idea of finding a strategic buyer that would give us a premium price,” cofounder Chuck Freeman said. “At first I wanted the money I deserved and whatever happens to the company happens, but that has changed.

I have come to really understand the value of our employees and our customers. I was taken with the idea of creating a legacy and leaving with something going forward that I helped start. I want to build something that will survive and thrive.

Freeman and the other two owners struggled to find a good fit. But after time with a lot of discussions and deliberate meetings, they found common goals and things they wanted to accomplish. They started working with OMEP on the mechanics on how a deal would work in which they could sell within the company, including developing a timeline and variables to define valuation.

“The only funding mechanism we had (insurance) required one of us to die or become disabled,” CabDoor partner Michael Fowler said. “So we created a capital account to set aside funds over time. Our shareholder agreement speaks to the intentionality of the capital account.”

Hiring the Right People to Prepare for an Exit

Selecting and developing that next level of leadership was also important. Fowler runs finances, Freeman runs sales, and Cliff Stites, the third owner, runs operations. They needed to consider all three legs of the stool, so they had to look at hiring from a different perspective. They needed to find someone who is interested in the long run and not just today.

Graphic Recording of the Owner’s Panel by Leah at Urban Wild Studios

First, they had to hire a salesperson and manager who wanted to commit to 10 to 15 years before wanting to exit and training his or her replacement. This forced them to talk a lot deeper about their commitments. They also worked out arrangements so all three of them wouldn’t be leaving simultaneously.

Being Flexible is Key to A Successful Business Transition

Are there processes that could be built into a company to make it an easier transition when owners choose to exit? Yes, to some extent, but flexibility is a must, according to Stuhr. There is a flow to deals, and the structure of his deal changed several times.

“Pre-planning is great, but your values in your 20s or 30s when you start are going to be different than your values in your 50s or 60s when you’re transitioning out,” Stuhr said.

“None of us go into business learning how to get out of business, so coming out is a rodeo ride. You may have in your mind the way you want to de-vest yourself from a company, but you have to realize for everybody to win, you may have to take a path that opens yourself to other solutions at the end.”

This article was co-written by Jennifer Campbell – Industry Group Leader, Schwabe Williamson and Wyatt

Jennifer Campbell leads a firm-wide team of attorneys focused on serving Washington and Oregon manufacturing, distribution and retail companies. She is committed to learning her clients’ businesses and industries in order to understand and appreciate legal issues from their perspective. This allows her to deliver tailored, client-focused advice and creative litigation strategies that help her clients solve problems.