The COVID-19 pandemic has increased remote work arrangements and dramatically altered work sites and offices. Some of those new arrangements may include employees working in states where the employer hasn’t previously conducted business or had a taxable presence.

If your employees are working from other states—or even other countries—there could be a number of issues your organization needs to address to comply with the jurisdiction’s payroll tax laws. For example, most states require employers to withhold individual income taxes on wages paid to employees based on where that employee is working.

Below, learn how to better navigate payroll tax considerations if your organization has employees working outside the states where your business is registered or in a state where the business hasn’t had previous activity.

Income Tax Withholding

Income tax withholding is generally required to be reported in the state where the employee is performing services. As a result, it’s important to track where your employees are performing their work—especially if they’re moving from state-to-state.

Income tax that is withheld from wages paid for work done in a particular state must then be remitted to the state—typically by registering and filing periodic withholding reports with the state’s department of revenue. At the end of the year, the employee will file individual income tax returns to reconcile these withholding payments based on their specific tax situation.

Income tax withholding generally is required on all compensation or wages paid to an employee including stock-based compensation such as restricted stock units or nonqualified options. Typically, when the employee takes possession of the shares at the vesting or exercise date, the income paid at that event will require income tax withholding.

The income tax withholding should consider where the employee worked during the vesting period, which can span a year or more for typical equity-based compensation plans. As more employees elect to move to different or remote-work jurisdictions during the pandemic, a company should establish an effective way of tracking employees’ remote locations and the amount of time worked in each location during the vesting period. This income tax withholding should be allocated based on the amount of time worked in office versus remote locations subject to regulatory rules.

Exceptions

The specifics of income tax withholding vary by state. There are several notable exceptions to income tax withholding including:

- Reciprocal agreements between states

- Telecommuting of back office employees

- De minimis thresholds—for example, the wage amount or days spent working in state

- COVID-19 exceptions issued by some state tax agencies

Unemployment Insurance

If wages are assigned to a new state, registration and compliance with the state employment department may be required to obtain unemployment insurance.

An employee’s wages are subject to state unemployment insurance (SUI) tax based on the following four factors in descending order:

- Localization. If all or most of the employee’s services are performed in one state, the wages will be assigned to that state for SUI purposes.

- Base of operations. If localization can’t be determined, wages are assigned based on the employee’s base of operations, which is where the employee starts work or customarily returns to receive the employer’s communications from customers or others.

- Place of direction and control. If neither localization nor base of operation apply, wages are assigned based on the employee’s place of direction or control, which is the place from which the employer exercises basic and general direction and control.

- Residence of employee. If none of the other tests apply, wages are assigned to the employee’s resident state.

Other state tax and compliance obligations to consider:

- Sales and use tax

- Entity-level income and franchise tax

- Gross receipts tax

- Worker’s compensation insurance—consider discussing state worker’s compensation insurance requirements with your private worker’s compensation insurance provider

- Secretary of state registration—consider discussing secretary of state registration requirements with legal counsel

- Local tax compliance

A number of cities and local governments implement payroll and other business taxes. If an employee of your company works in one or more of these cities, there may be additional local tax filing requirements.

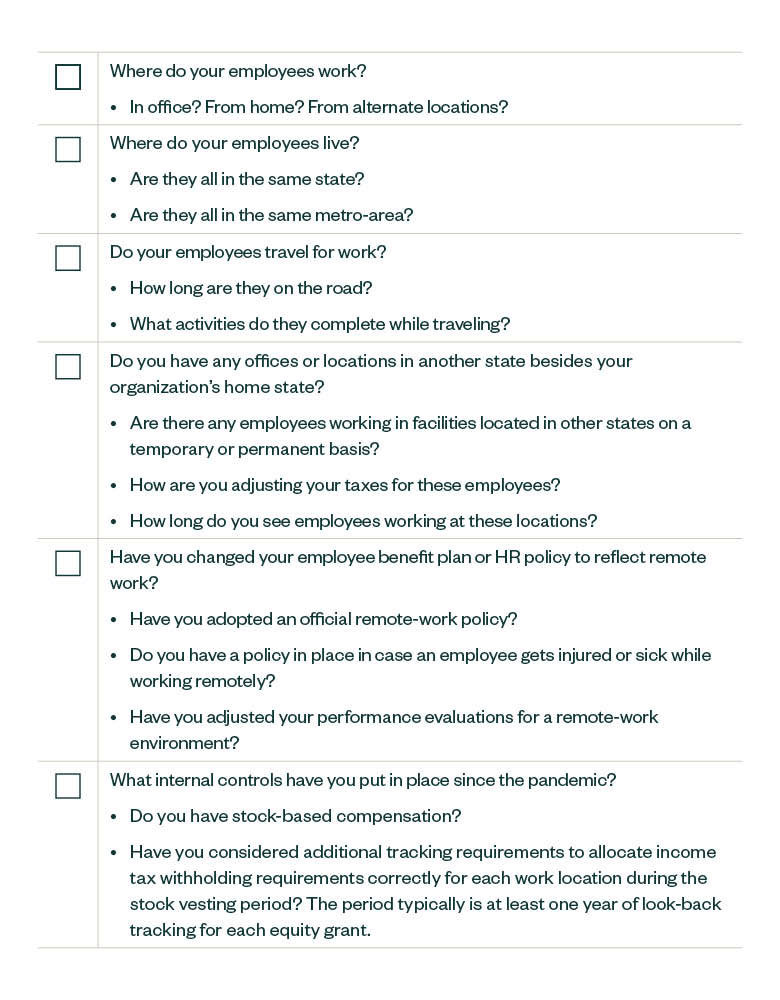

Questions to Help Identify Risk

With more employees working remotely, employers may now have payroll tax filing obligations in jurisdictions where they didn’t previously operate.

Answering the questions below will help identify jurisdictions where your employees’ activities may have created payroll tax filing obligations.

Moss Adams is Here to Help

If you have any questions regarding your remote employees and how they might affect your state-to-state payroll tax considerations, please contact your Moss Adams professional.